ALICE, an acronym for Asset Limited, Income Constrained, Employed, is a new way of defining and understanding the struggles of households that earn above the Federal Poverty Level, but not enough to afford basic necessities.

For far too many families, the cost of living outpaces what they earn. Yet these workers perform jobs that are critical to the functioning of our local communities – educating our children, keeping us healthy, and making our quality of life possible. When funds run short, these households are forced to make impossible choices, such as deciding between quality childcare or paying the rent, filling a prescription, or fixing the car.

During Black History Month, we know it is important to highlight the reality that rates of financial hardship differ significantly between white and Black families.

Household Financial Status and Key Demographics

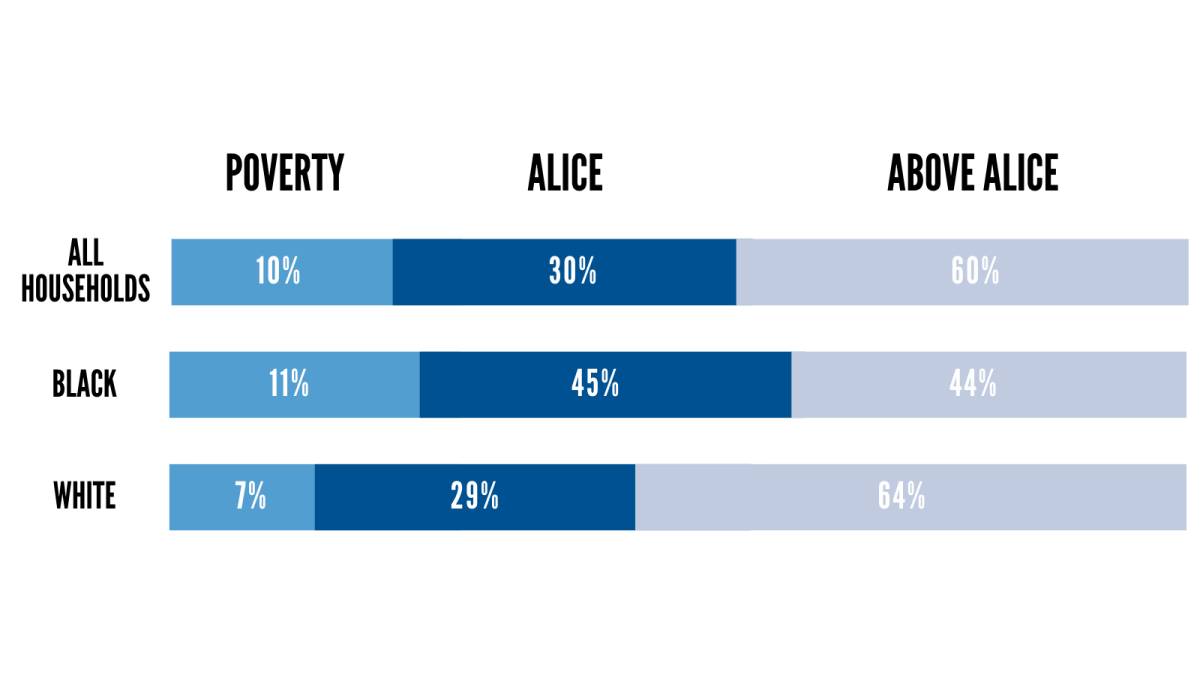

Below is the financial status breakdown of households by race in York County, SC. A staggering 56% of Black households do not earn enough to make ends meet compared to 36% of white households.

Why are Black Families Experiencing Financial Hardship at a Higher Rate?

The Persisting Wage Gap

In South Carolina, Black workers earned 73 cents for every dollar made by White workers in 2019.

This is true even accounting for educational attainment: college-educated black men earn roughly 80% of the hourly wages of white college-educated men with the same degree.

An attribute of this is described as “The Broken Rung”: Black Americans face lower rates of career advancement than other racial groups, making them less likely to be promoted to management (higher-paying) positions. This is caused by internal employment discrimination, where white managers are more likely to hire/promote/grant a pay raise to someone who is the same race as them- perpetuating the cycle of racial prejudice and discrimination in the workplace.

Work Opportunities

Though the majority of adults in South Carolina were working in 2021 and most households had at least one worker, only 21% of working-age adults had the security of a full-time job with a salary. Of those in the labor force, more than half (59%) were paid hourly and/or worked part-time. Out of part-time workers, Black workers were more likely than White workers to be part-time (i.e., working less than 35 hours per week despite wanting to work full-time because their hours had been reduced or they were unable to find full-time jobs).

Occupational Discrimination

Additionally, Black American employment is concentrated in low-paying jobs such as cashiers and janitors (job positions where the worker is more likely to be ALICE).

This is largely attributed to hiring discrimination where Black Americans are less likely to be hired in higher-paying jobs due to racial discrimination. In recent studies, discrimination was found in the form of name bias. Names like “Emily” and “Brad” are more likely to get callbacks after submitting an online or mail-in application as opposed to those with names associated with Black Americans such as “Lakisha” and “Jamal.”

Better Economy for All

Black Americans have a crucial part to play in the overall economy. When everyone is granted equity, there are societal benefits that increase the efficiency of a whole community. In fact, it is projected that closing the racial wealth gap could net the US economy between $1.1 trillion and $1.5 trillion by 2028. Addressing racial discrimination is not only crucial in addressing social and economic injustice, but it is taking a step toward pulling all people out of economic hardship in a meaningful way. The long-term impacts of addressing racial discrimination will demonstrate what happens when a society prioritizes helping less advantaged people within society, and how that advances all people.